Large property owners are again challenging their assessments and threatening to sue the City of Madison for $1.4M. Can you imagine what the city could do with that money? Or what they will do without it?

How many firefighters and police officers will that pay for? And how much money is the city spending staffing these meetings and fighting these assessments. When I was at the Board of Review there were about 6 city staff there and then the had to spend time preparing. And now the city attorney is spending time on these cases as well as the Clerk and Risk Manager. $1.382M is what is needed to add a 9th ambulance.

WHO IS SUING THE CITY OF MADISON?

Well, they’re all LLCs, so who the people are that are hiding behind the LLCs isn’t always easy to figure out. But when you dig deeper it’s affordable housing projects we funded, projects that got TIF, places the City of Madison rented (Pinney Library) and areas that are about to benefit from City Planning processes. Yeah. It’s also hotels and high end apartments that are supposed to be adding to our tax base, but then fight to reduce their contribution.

Items 54 – 69 are another set of developers notifying they are going to sue the city for excessive assessments of their property.

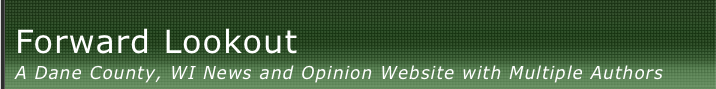

- Alan Marcuvitz, von Briesen & Roper, S.C., attorney for Madison Joint Venture LLC, East Towne Mall, 89 East Towne Mall – excessive assessment – $28,799.78

- Original Assessment – $63,944,000

- Board of Assessors adjusted to – $63,720,000

- Board of Review agreed with the adjusted assessment

- They believe the correct assessment is – $62,444,000

- Alan Marcuvitz, von Briesen & Roper, S.C., attorney for Madison Joint Venture LLc, West Towne Mall, 66 West Towne Mall – excessive assessment – $436,600.71.

- Original Assessment – $81,696,200

- Board of Assessors increased the assessment – $88,900,000

- Board of Review agreed with the adjusted assessment

- They believe the correct assessment is $69,500,000

- Don Millis, Reinhart Boerner Van Deuren S.C., attorney for Veritas Village, LLC, 110 N. Livingston St. – excessive assessment – $318,584.00.

-

- This is Terrence Wall

- Original assessment $25,000,000

- Board of Assessors raised it to $29,820,000

- Board of Review reduced it to $28,500,000

- They believe the correct assessment is $14,375,924

- They also objected to their assessments in 2018 ($17,780,000 sustained and they filed a claim to sue for $247,214) and 2016 ($2,200,000 sustained and they filed a claim to sue for $33,443)

- Don Millis, Reinhart Boerner Van Deuren S.C., attorney for CP Stern, LLC and Star Investments, LLC – excessive assessment – $26,926.00.

- Original assessment $2,640,000

- Board of Assessors agreed

- Board of Review reduced it to $2,400,000

- They believe the correct assessment is $1,206,283

- Property is at 209 Cottage Grove Road

- They also objected to their assessments in 2015 ($2,600,000 was reduced to 2,400,000) and 2019 ($2,400,000 was sustained and they filed a claim to sue for $33,841)

- This was the temporary location of Pinney Library in the old Ace Hardware location.

- Don Millis, Reinhart Boerner Van Deuren S.C., attorney for Lion’s Gate, LLC – excessive assessment – $48,933.00.

-

- Original assessment $4,000,000

- Board of Assessors raised it to $4,460,000

- Board of Review reduced it to $4,340,000

- They believe the correct assessment is $2,170,592.

- Property is at 5801 Gemini Drive, David Baehr and Casey Louther (Luther and Assocaites) were the applicants

- Don Millis, Reinhart Boerner Van Deuren S.C., attorney for 8Twenty Park, LLC (Tax Parcel No. 0709-262-2999-3) – excessive assessment – $22,645.00.

-

- This is JT Klein, Inc.

- Original assessment $3,268,900

- Board of Assessors agreed

- Board of Review agreed

- They believe the correct assessment is $2,400,000

- Property is located at 903 Delaplaine Ct, Unit TIF (<-not sure what that means)

- They got $1.25 million for affordable housing for phase I and proposed 56 affordable housing units of 67, affordable to people at 30-60% CMI.

- Don Millis, Reinhart Boerner Van Deuren S.C., attorney for 8Twenty Park II, LLC – excessive assessment – $20,624.00.

- Original assessment $2,801,800

- Board of Assessors agreed

- Board of Review agreed

- They believe the correct assessment is $2,000,000

- Property is located at 903 Delaplaine Ct, Unit PHS2 (<-not sure what that means)

- They got $1.25 million for affordable housing for phase I and proposed 56 affordable housing units of 67, affordable to people at 30-60% CMI.

- Don Millis, Reinhart Boerner Van Deuren S.C., attorney for 8Twenty Park, LLC (Tax Parcel No. 0709-262-2901-8) – excessive assessment – $22,645.00.

- Original assessment $3,268,900

- Board of Assessors agreed

- Board of Review agreed

- They believe the correct assessment is $2,400,000

- The property is located at 903 Delaplaine Ct

- They got $1.25 million for affordable housing for phase I and proposed 56 affordable housing units of 67 providing housing, affordable to people at 30-60% CMI.

- Don Millis, Reinhart Boerner Van Deuren S.C., attorney for Beltline Hotel Partners II, LLC – excessive assessment – $101,422.00.

-

- Project is Sleep Inn and Suites, a 92 unit hotel.

- Original assessment $8,177,000

- Board of Assessors agreed

- Board of Review agreed

- They believe the correct assessment is $3,900,000

- The property is located at 4802 Tradewinds Parkway

- Kevin Wilson (Beltline Hotel Partnership II), Jim Gorsich (Dimension IV) and B&R Enteprises were the applicants for this project

- Don Millis, Reinhart Boerner Van Deuren S.C., attorney for Madison East Parntership, LLC – excessive assessment – $67,208.00.

-

- Original assessment $8,642,000

- Board of Assessors agreed

- Board of Review agreed

- They believe the correct assessment is $6,000,000

- Property is located at 116 Milky Way

- Don Millis, Reinhart Boerner Van Deuren S.C., attorney for Tree Lane Apartments, LLC – excessive assessment – $18,370.00.

-

- Yes, its THAT Tree Lane, the one that has 20 CDA Vouchers, that got $1,615,000 from the City in Affordable Housing Funds, that the city attempted to declare a blighted property, that the city added $275,250 for additional services and $145,000 for security.

- Original assessment $2,230,000

- Board of Assessors and Board of Review did not review it because they claim there was no notice

- They believe the correct assessment is $1,415,603.

- The property is located at 7933 Tree Lane

- Don Millis, Reinhart Boerner Van Deuren S.C., attorney for Landmark Oaks Development, LLC – excessive assessment – $69,081.00.

-

- Bradley Hutter is the owner

- Original assessment $16,670,000

- Board of Assessors reduced it to $13,580,000

- Board of Review reduced it further to $12,500,000

- They believe the correct assessment is $10,000,000

- The property is located at 2921 Landmark Place

- This project got TIF funding of $913,000 and said they would retain 255 jobs in the City of Madison.

- The TIF application has the estimated value of the project at $20,451,000 which is twice the value they are now claiming the project is worth?

- Don Millis, Reinhart Boerner Van Deuren S.C., attorney for RSS WFCM2013LC12-WI CPM LLC – excessive assessment – $82,184.00.

-

- This is the Crowne Plaza

- Original assessment $9,500,000

- Board of Assessors agreed

- Board of Review lowered it to $9,070,000

- They believe the correct assessment is $5,750,000

- The property is located at 4402 E. Washington Ave

- Eric Hatchell, Foley & Lardner LLP, for Esker Apartments LLC – excessive assessment – $13,478.77.

-

- Original assessment $1,950,000

- Board of Review reduced it to $1,879,000

- They believe the correct assessment is $1,357,808

- They are claiming that the sales price of the property that the city based the assessment on includes $592,191 in park impact fees.

- Property is at 2801 Hickory Ridge Road

- Eric Hatchell, Foley & Lardner LLP for Mirus Madison II LLC – excessive assessment – $59,001.32.

- Original assessment $8,750,000

- Board of Review affirmed the assessment

- They believe the correct assessment is $6,500,000

- They are claiming that the calculations are based on a blended rate for affordable and market rate housing resulting in an over-assessment of the property.

- The property is located at 1520 Troy Drive

- Mirus is a partner Movin’ Out and got $1.1M for The Ace Apartments from the Affordable Housing Fund.

- Eric Hatchell, Foley & Lardner LLP, for Bird Dog Hospitality IV – excessive assessment – $49,535.99.

-

- Original assessment $8,500,000

- Board of Review agreed

- They believe the correct assessment is $6,500,000

- They say basing the assessment on the recent sales fails to take into consideration other costs included in the sale, including the use of the Best Western brand.

- Property is located at 4801 Annamark Drive

- They also filed a claim to sue in 2019 for $8,166

OCTOBER 30TH BOARD OF REVIEW

I attended the meeting of the Board of Review on October 30th. I was curious why all the large property owners and developers continue to challenge their assessments. At this meeting they heard arguments from Terrance Wall (4603 DiLoreto Ave) and East and West Town malls. It was the first time I ever attended one of these meetings in 20 years. Unfortunately, here’s another case where there were all kinds of materials presented, but they aren’t in legistar and easily accessible for the public. My guess is the developers want it that way so other developers can’t see their documents.

I had the meeting audio recorded, but I lost it in a computer crash in November – I was between backups! Boo. From memory and from the minutes I can tell you this.

At that meeting Terrance Wall got a portion of what he wanted, and actually argued the merits of his case. The assessment was lowered from $8,980,000 to $7,700,000. He got a portion of what he wanted, but not all.

East Towne and West Towne tried to argue a technicality. They did not get the waiver they were asking for. The tax assessments were upheld. I recall thinking that they didn’t make a very good argument and that they said something to the effect that they just wanted to make this procedural argument so they could move on and be heard in the courts.

OK KONKEL, WHY DO YOU CARE?

a) $1.4M in the city budget is ALOT. It’s about enough firefighters for a new fire station.

b) People are pressured to support development projects because they add to the city’s tax base. But after all the costs the city has for the development in infrastructure around the building and fighting these cases, what does the city really gain?

c) The city is about to embark on a planning process around East and West Towne Malls. My guess is that will only increase the value of those properties. So why are they fighting the city on their property tax assessments?

d) This is a pattern, every year. It’s hard to track and we often don’t hear the results for quite some time. I haven’t seen an overall briefing to the council on this, but how much are we losing every year in these battles?

e) Developers over inflate the value of their properties when they are trying to get TIF money from the city, then claim afterwards that the property isn’t worth as much as they claimed in their TIF applications.

f) The assessments are all at prices lower than the fair market rate.

g) I’d like to look up the contributions to our local elected officials and see how much money they contributed to campaigns but it is near impossible given that people hide behind LLCs AND there is no easy way to look that up for the City of Madison. It would take hours and hours and hours of research with the records the way they currently are.

h) I’m concerned that city partners at Tree Lane would be suing for $18,000 after all the money we dumped in to their project.

i) If the affordable housing projects are correct, why are we costing them more money that they have to spend on attorneys instead of keeping the housing more affordable.

You can add your concerns here. It just seems like this is a lot of effort being expended and many of these entities suing us are our partners in various efforts. Seems like these issues should be solved before they even get to the Board of Assessors and Board of Review. And definitely before they are threatening to sue.

This is a very informative article. I worked for the Assessor’s Office for over 20 years. The assessment ratios were recently released for last year. The ratio for Madison was 93.97% of market value. Residential assessments were 99.05% of market value, but commercial assessments were only 90.05% of market value. That is very unfair for residential property owners. In 20 years, I’ve never seen such disparity.

Brenda –

You conveniently ignore that RENTERS have to pay those outrageously high taxes. At one of our downtown properties each tenant pays $3,500 per year in taxes in their rent! That’s more than most homeowners pay in taxes across the U.S. On the east side, residents pay $2,500 per year. Property taxes have become the single largest expense at an apartment property. The taxes are so high that it’s become impossible to earn even a below average return, which means not building more and/or the only other choice is to sell to an out of town buyer, which then would result in higher rents since out of town landlords don’t care about the residents. Local landlords try to hard to keep rents down for residents – to retain them. But huge increases in taxes have forced big increases in rents to just stay even, and that’s not fair to residents. The city of Madison talks a good talk about affordable housing, but does everything in its power to stuff a larger percentage of their tax revenue collections onto renters rather than homeowners because renters don’t vote as much.

And the so-called fair market value you mentioned is not the fair market value; it’s an arbitrary determination by the same city assessor, who has been directed by the city to raise the assessments. The assessor finds one or two sales in the marketplace to an out of state firm, typically a REIT or other firm that doesn’t pay corporate income taxes (so they can pay more in prices for assets), and then the assessor claims that is the ‘market’, even though during a downturn the same assessor will argue that one or two low priced sales are ‘not the market’. It’s a joke. The assessor’s office talks out of both sides of their mouth.

You are right about one thing though, in regards to the Section 42 ‘affordable housing’ developers. It’s ironic that they are suing for lower assessments when they received numerous subsidies, including TIF, WHEDA tax credits, trust fund money, etc. AND they take out millions of dollars in upfront cash fees to themselves. Whereas market rate developers like myself, we contribute millions in equity capital to the project upfront, don’t take out fees upfront, and leave our equity in long-term, while the Section 42 developers are pocketing millions, almost always equal to all those cash subsidies they received from the city. (If the city is going to provide TIF to those developers, the TIF agreement should prohibit the payment of those fees to the developers upfront and require that they leave those fees in.)

Oh, and by the way, one reason there is a housing shortage is because of your push to get the Inclusionary Zoning ordinance passed, which was later ruled unconstitutional. That ordinance led to a ten year shortage of new market rate construction, which led to vacancies going away and large increases in rents. The city is still suffering from the damage you did, but hey, thank you, because you eliminated our vacancies back then.

And if you aren’t convinced about whether we developers are right, well, the Board of Review agrees with us, having reduced hundreds of over assessments – basically proving that the assessor’s decision was wrong. Likewise, the courts also have agreed too, reducing assessments. In fact, over 350 appeals have been filed in just last year or so, indicating how the city assessor is sticking it to renters and hotels in particular.

In conclusion, it’s easy for you to paint a false picture and make stuff up, but the facts are on our side and your failure to sympathize with the renters you were supposed to represent at the Tenants Union is really disconcerting. Maybe that’s why the kicked you out – were you were to busy playing politics than to bother with addressing real issues? or was it the financial improprieties we read about? Well, either way, I have not seen you take the risk or put up the capital or sign a personal guarantee on a construction loan to build even a single MF unit of housing; not one. So who are you to criticize? How about you go out and build some housing?

Ahem. I have built housing and did co-sign the loan for the project. It’s called Occupy Madison Tiny House Village. Went through the entire Planned Development process. I also “put up capital”/loaned the project money to get started.

I enjoyed your little rant/personal attacks on me. Been quite some time since we sparred. Needless to say, you got many of your facts wrong – again.

IZ for rental housing was only in place for a very short time, no way it stopped the market from building rental housing for 10 years.

And there was no financial mismanagement at the TRC – it was a hoax. In fact, they hired me back and some of the contracted work I did for them was on their 2020 budget and verifying contract/grant payments.

Thanks for playing.

Mr Matthews,

Your data is incorrect. Your stated residential % is too high. Your stated Commercial % is too low. Your overall % is too low. Please search the DOR for major class comparison published 2/12/2020 . Thank you.